unemployment federal tax refund update

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received. THE IRS is now sending 10200 refunds to millions of Americans who have paid unemployment taxes.

Tax Refund Stimulus Help Facebook

If you received unemployment benefits in 2020 a tax refund may be on its way to you.

. In Texas unemployment pay is reported on federal returns as taxable income. 1222 PM on Nov 12 2021 CST. Unemployment 10200 tax break.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. 24 and runs through April 18. On April 6 2021 the.

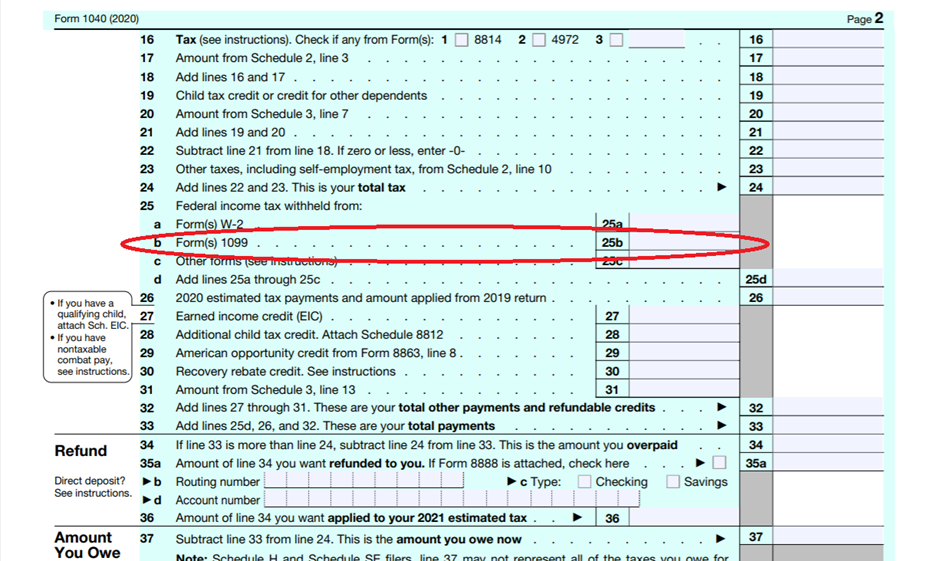

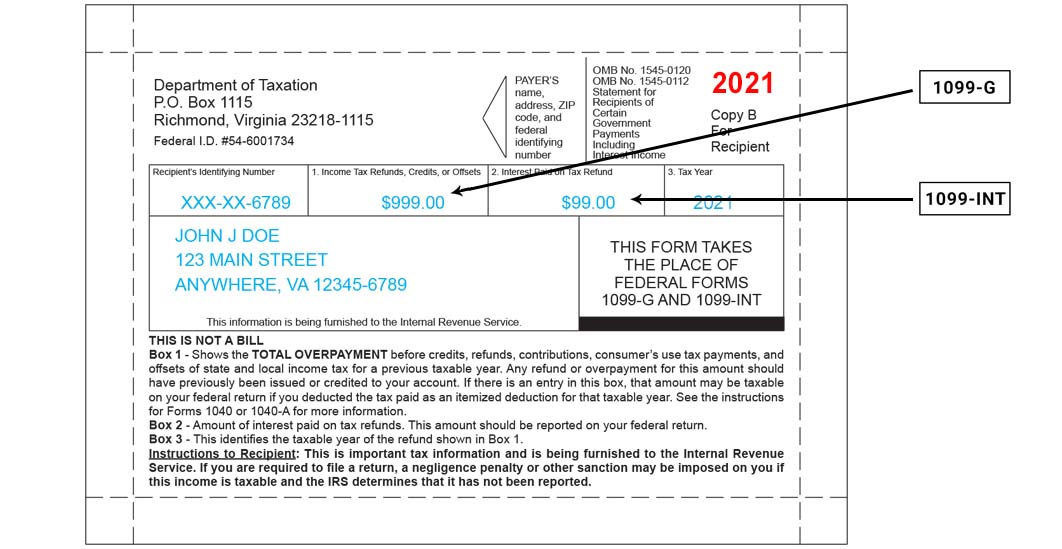

Anyone who received jobless benefits in 2020 will be sent a 1099-G form which contains the. Tax season started Jan. The federal tax code counts.

IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Find information on Reporting Unemployment Benefits to the IRS this includes information.

On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update. Around 10million people may be getting a payout if they filed their tax. Update On The Federal Unemployment Benefits Deduction For Taxpayers Who Filed Prior To The Enactment Of The American Rescue Plan Act.

Refunds set to start in May Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment. Tax refunds on unemployment benefits to start in May. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Some people received direct deposits from IRS TREAS 310 as part of 28 million refunds IRS sent this week to taxpayers due money for taxes on unemployment in 2020. The IRS has sent 87 million unemployment compensation refunds so far. Changes in how Unemployment Benefits are taxed for Tax Year 2020.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

Unemployment 10 200 Tax Break Some States Require Amended Returns

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Misleading Post Links Unemployment Benefits Reduced Tax Refunds

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

1099 G 1099 Ints Now Available Virginia Tax

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

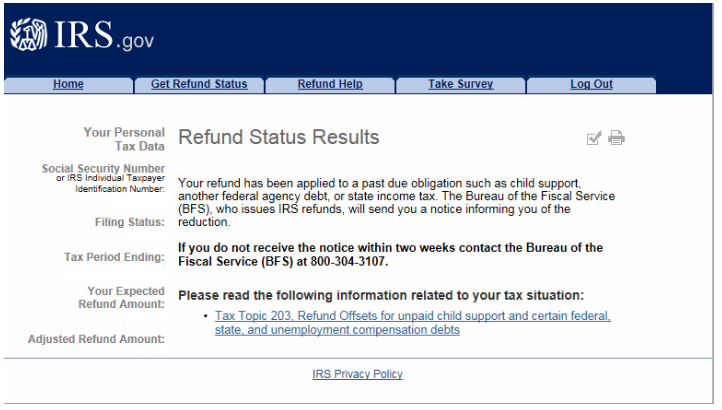

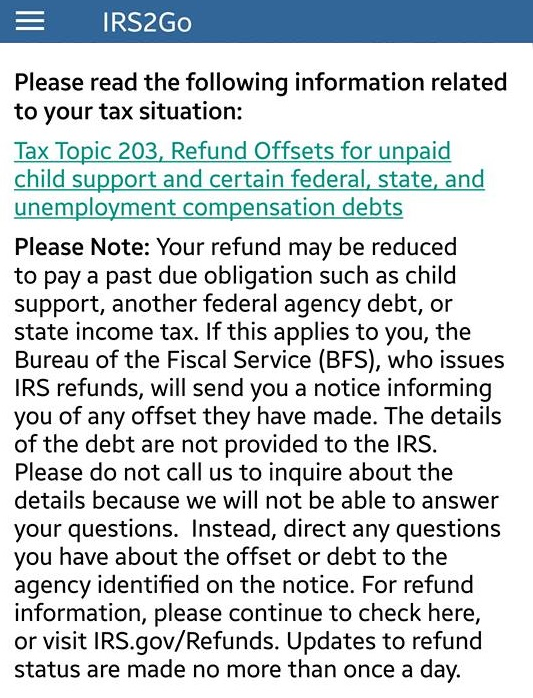

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

Tax Refund Offsets Where S My Refund Tax News Information

Irs Unemployment Tax Refund Update Direct Deposits Coming

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Year End Tax Information Applicants Unemployment Insurance Minnesota

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Where S My Refund Tax Refund Tracking Guide From Turbotax

Unemployment Tax Refund Update What Is Irs Treas 310 10tv Com

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post